The Leveraged Loan Market’s Resiliency: From Covid-19 to Recovery

Brought to you by BancAlliance

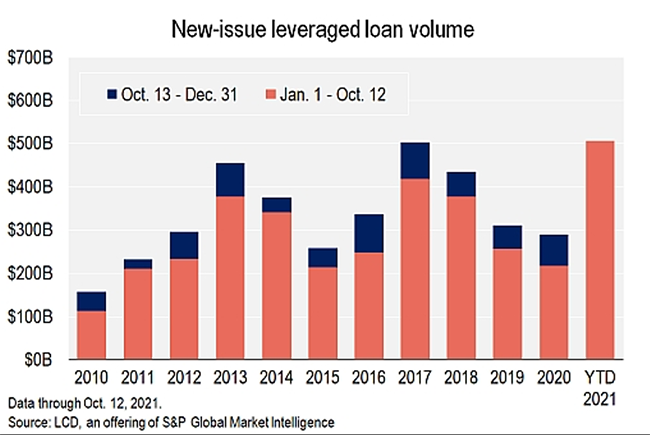

The leveraged loan market has experienced a roaring recovery from the depths of 2020. The industry has already set a full-year issuance record with $505 billion of new issuance through October, topping the previous full-year peak set in 2017 of $503 billion.

A leveraged loan is typically secured by a first lien on the assets of the business and will often have the following characteristics:

- Debt based on a multiple of Earnings Before Interest, Depreciation and Amortization (EBITDA).

- 5 to 7 year maturity.

- Floating interest rate tied to an index (LIBOR, but soon to be SOFR).

- Amortization ranging from 1% to 5% per year.

- Private equity (“PE”) contributions typically ranging 25% to 50%, implying loan to values of 50% to 75%.

The most frequent issuers in the leveraged loan market are companies backed by PE firms that seek to lever their investment in a business to maximize the return to investors. Strategic acquirers or public companies often don’t need to access this market; they have currency in the form of their stock or readily have access to other forms of capital, such as investment-grade bonds.

The primary investors in the leveraged loan market are collateralized loan obligations, or CLO funds, which represent about 70% of the primary issuance market. The Federal Reserve estimates that institutional investors, including insurance companies, mutual funds and pension funds, and banks hold about three quarters of U.S. CLO securities owned by U.S. residents. Insurance companies alone account for about a third of U.S. residents’ holdings.

In practice, both regulated and non-regulated financial institutions will arrange a loan, either fully committed or on a “best-efforts” basis, and syndicate the loan to investors. However, there has recently been an influx in the market of direct or private lenders that look to commit to and hold an entire loan facility, thereby eliminating the uncertainty of the syndication process.

The V-Shaped Recovery

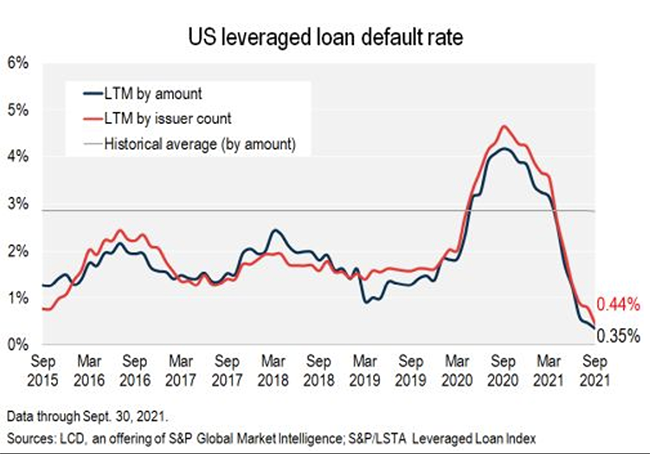

The leveraged loan default rate briefly spiked to about 5%, due to the Covid-19 lockdowns, before quickly returning well below the historical average of around 3%. This compares to a default rate of 10.8% during the peak of the recent financial crisis. The default rate is now well below 1%, its lowest level since December 2007.

Another market barometer is pricing on secondary loans. Based on the S&P/LSTA loan index, which reflects the performance of the largest facilities in the leveraged loan market, prices for over 95% of the loan market for performing loans fell below 90 cents on the dollar for a brief period in early 2020. As we enter the fourth quarter of 2021, the market has stabilized with most performing loans trading at or near par value.

Fueling the Recovery

There are several key factors driving the booming leveraged loan market. From the demand side, investors continue to seek higher-yielding debt due to low Treasury yields. Additionally, the current mix of high-yield debt outstanding has significantly shorter average durations than investment-grade bonds, which makes high yield less exposed to value degradation as rates rise.

On the supply side, competition among an influx of lenders has caused PE firms to take advantage of the demand through record-setting new leveraged loan issuance. PE firms are taking advantage of the frenzied demand for high-yield debt – not only to fund leveraged buyouts, but also for record levels of dividend recapitalizations and refinancing activity. Firms are looking to utilize low rates before an anticipated Federal Reserve interest rate increase in 2023. PE firms have closed on over 6,000 deals worth a combined $787.6 billion through the third quarter of 2021 – already the highest ever full-year numbers – according to Pitchbook.

Where Do We Go From Here?

Based on S&P’s LCD Leveraged Finance Survey for the third quarter, the average expectation of the default rate is 0.98% in one year. This signals a slight increase from where the industry is today, but is well below the historical 3% average.

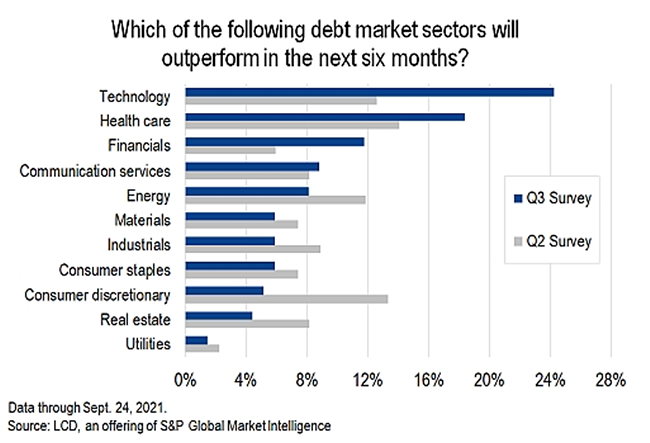

The same survey revealed that credit managers see pandemic-related impacts, inflation and Fed liquidity as potential speed bumps to a continued recovery. However, the low default rate forecasts indicates that these concerns are not significant enough to blunt the recovery. Not surprisingly, industries that have low price elasticity and/or are viewed as “Covid-19 resistant” are leading the way for areas of perceived outperformance.

While there have always been risks associated with the leveraged loan market, it has once again proven resilient. Unlike the Great Recession and financial crisis, there is no impending near-term maturity wall and, at least for the time being, smoother sailing ahead.