The IPO Market is Red Hot. What’s Driving It?

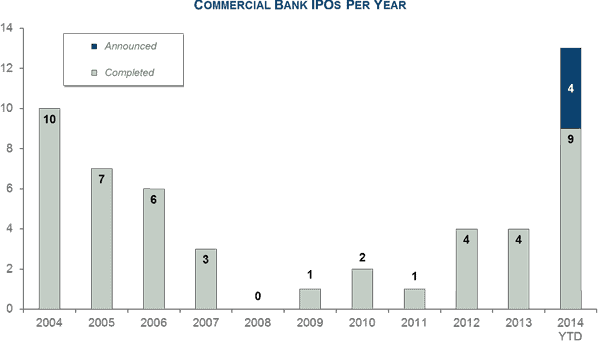

The market for bank initial public offerings (IPOs) has become scorching. In fact, through the first three quarters of this year, nine initial public offerings of commercial banks have been successfully completed. Based on the current pipeline, this year will mark the most bank IPO activity in the last decade.

Source: SNL Financial; Year-to-date through September 30,2014

During September, Citizens Financial Group Inc. (NYSE: CFG) completed the largest bank IPO on record, at $3.4 billion in gross proceeds. To put the size of this offering into perspective, the second largest offering this year was approximately $232 million for Talmer Bancorp Inc.

Given the active IPO market, bank directors and investors alike have asked us: What has spurred the pick-up in IPOs? What characteristics do great IPO candidates have in common? Are there more to come? Will this have an effect on M&A activity? To shed some light on these, we will address each question.

What Has Spurred the Pick-Up in IPOs?

A number of factors that have contributed to or helped facilitate the pick-up in activity such as higher valuations, the emerging growth company provisions in the JOBS Act, the need to repay Troubled Asset Relief Program money or another form of capital, as well as supportive capital markets. Bankers have referenced a combination of pent-up demand for liquidity from some shareholders and the need to fund future growth. Going public provides shareholder liquidity for those who want it while allowing management teams and committed investors alike to continue to pursue the long-term strategic plan. Furthermore, having access to the public markets is a significant advantage for growth-minded companies regardless of whether the growth is organic or through acquisitions.

Characteristics of Good IPO Candidates

So what makes a good IPO candidate?

- Management: Investors are interested in banks led by an exceptional management team with a proven track record.

- Size: While a few have fallen outside of the range, most banks are between $1 billion to $5 billion in assets at the time of their IPO.

- Profitability: Investors want to see both a solid profitability trend and earnings growth— top line growth while managing expenses to improve the bottom line.

- Clean balance sheet: Especially at this point in the cycle, balance sheets should be in good shape.

- Growth: A growing bank in a high-growth market is the ideal situation, but solid growth prospects are key, whether organic or through acquisition opportunities.

Are Rising Valuations Justified?

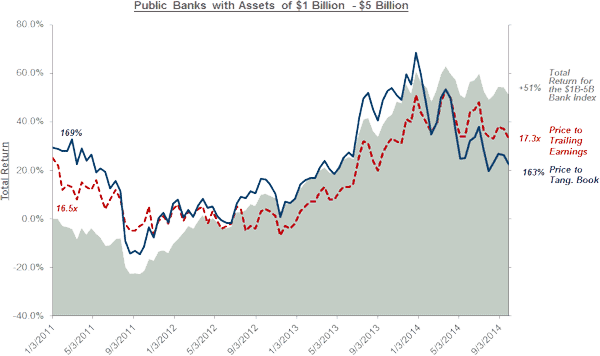

While IPO valuations are up on average, the pricing of recent deals has been reasonable relative to the valuations of similar public banks. For example, of the thirteen banks that have completed an initial public offering during the last two years, nine of these were within $1 billion and $5 billion in assets at the time of their IPO. Three of the four others were within $350 million of this size range with Citizens Financial Group being the exception. We analyzed all publicly traded banks in this size range and found that the group currently trades at approximately 163 percent of tangible equity, which supports the pricing of recent offerings. Interestingly, banks in this size range are currently trading close to the same multiples they traded at roughly three and a half years ago; however, they have returned over 51 percent on average to investors during this same period.

Source: SNL Financial; Data from 1/3/2011-9/29/2014

Will This Affect M&A Activity?

Issuing stock in a merger or acquisition helps a buyer achieve the higher capital levels that regulators want on a pro forma basis while helping to ensure attractive payback periods for investors. In fact, during the past two years approximately 86 percent of deals where the purchase price was $25 million or more have included stock as a portion of the consideration. Accordingly, the majority of banks that have completed an IPO this year have stated the intent to evaluate acquisition opportunities.

Conclusion

We expect this pick-up in IPOs to continue into 2015. Furthermore, we expect this trend to drive more M&A activity as well. Current valuations are drawing more banks to access the public markets and investors are interested in profitable institutions with compelling growth prospects. Many of these newly public banks intend to pursue acquisitions which will be conducive to continued consolidation throughout the banking industry. Accretive acquisitions are a catalyst supporting higher stock prices for the buying banks, which will serve to further lure more growth-minded bankers to consider an initial public offering.