Alexa, What’s My Checking Account Balance?

When Capital One Financial Corp. launched its integration with Amazon’s Echo device in early 2016, it was the first bank to give customers the ability to ask Alexa about their finances. Just like she’s able to tell users about the daily news and weather, Alexa can immediately answer customers’ questions about their checking, savings, credit card, and home and auto loan accounts.

“Conversational interfaces are the future of how people will engage with technology,” said Jim Kresge, head of mobile payments technology at Capital One, in a blog post for Amazon. “The Capital One skill for Alexa has enabled us to serve our customers through a differentiated experience and most importantly, making it even easier to manage their money whenever and wherever they are. Using the new skill for Alexa, Capital One customers can manage their money easily (hands free) and intuitively (conversational UX).”

Capital One customers can also ask Alexa about transactions at more than 2,000 merchants, including Starbucks, Whole Foods and Amazon. Customers can ask about their spending on a specific date or through a select time period, using natural language.

American Express Co. launched its integration with Alexa in May 2017, allowing the company’s card holders to check their account information and pay bills, and also access Amex Offers, which are exclusive discounts available to customers through their American Express card. U.S. Bancorp launched its Alexa skill in September 2017, giving their customers a new way to check account balances and transaction history.

American Express Co. launched its integration with Alexa in May 2017, allowing the company’s card holders to check their account information and pay bills, and also access Amex Offers, which are exclusive discounts available to customers through their American Express card. U.S. Bancorp launched its Alexa skill in September 2017, giving their customers a new way to check account balances and transaction history.

Bank of America Corp. will launch its own digital assistant, Erica, which customers can interact with inside the bank’s mobile app via voice or text message.

The era of the digital assistant

Work, communication, education and finances have evolved from being managed on paper, to the computer, to now on our mobile devices. And the evolution continues as we enter the era of the digital assistant. In addition to the Amazon Echo, key players include Google Home and the Apple Homepod. Even Walmart is making the shift. The retailer partnered with Google to offer their products to shoppers using the Google Express digital shopping mall, so Walmart customers can place orders by speaking to Google Home or using the Google Assistant on Android.

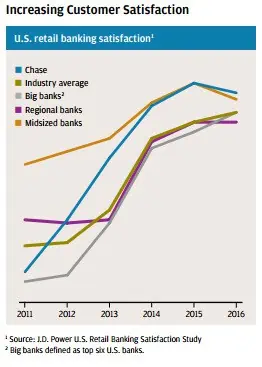

Like these leading banks and retailers, the best companies are finding ways to get rid of complicated menus in their apps and create a more convenient experience for customers. According to the J.D. Power U.S. Retail Banking Satisfaction Study, JPMorgan Chase & Co. leads U.S. retail banks in customer satisfaction levels, followed by midsized banks, big banks and lastly, regional banks.

While it’s common to believe that a big bank will never be able to provide the personal customer service that a community bank can, big banks are soaring ahead with advances in technology—a leg up that is making the big banks more convenient and therefore more desired by customers.

While it’s common to believe that a big bank will never be able to provide the personal customer service that a community bank can, big banks are soaring ahead with advances in technology—a leg up that is making the big banks more convenient and therefore more desired by customers.

It takes about 10 minutes to open a Capital One account online—already a score in convenience. Integration with Alexa is just as easy: Download the Amazon Alexa app and enable the Capital One skill. (“Skills” are Amazon’s name for Alexa apps.) Enter your Capital One account login information, and you’re ready to talk to Alexa about your account.

Of course, privacy concerns come into play when your bank account information is being accessed through a digital device like Alexa. In the setup process, customers can add a pin number that they’re required to tell Alexa before she shares any account information.

“Security is first and foremost in our mind as we develop any new product,” said Ken Dodelin, Capital One’s vice president of digital product management, in an interview with Mashable. The Capital One account information is encrypted, so even Amazon cannot access it, according to Dodelin.

“Our goal in developing the Alexa skill is to design for real-life conversations about money,” said Stephen Hay, head of content strategy and AI design at Capital One. “We want customers to speak naturally and feel confident we’ve got their back every time, wherever they are in life.”