ESG: Walk Before You Run

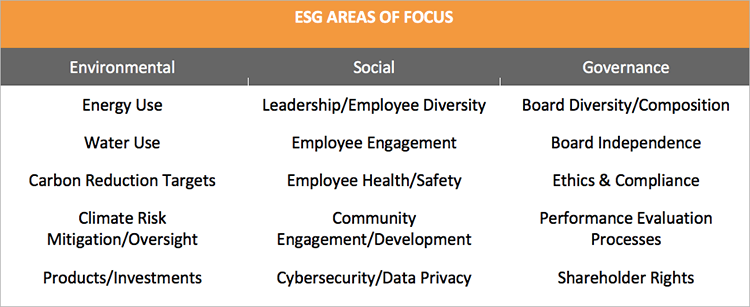

Covid-19 and last year’s protests over racial injustice added to the mounting pressure corporations face to make progress on environmental, social and governance (ESG) issues – but banks may be further ahead than they believe.

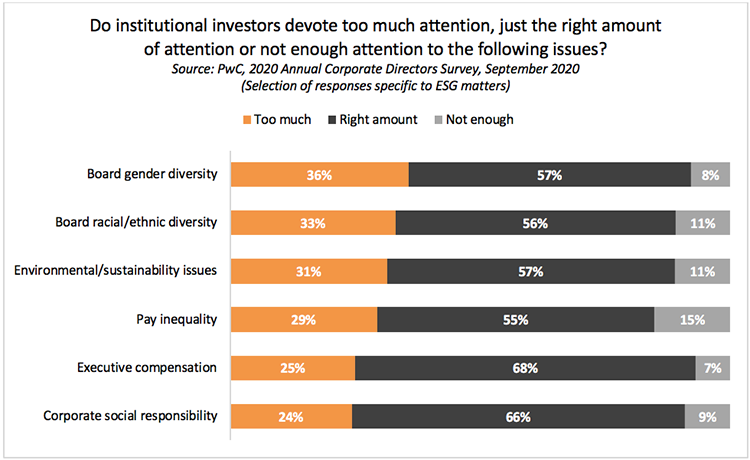

“ESG took on a life of its own in 2020,” says Gayle Appelbaum, a partner at the consulting firm McLagan. Institutional investors have slowly turned up the heat on corporate America, along with community groups, proxy firms and ratings agencies, and regulators such as the Securities and Exchange Commission, which now mandates a human capital management disclosure in annual reports. Customers want to know where companies stand. Prospective employees want to know if a company shares their values. And President Joe Biden’s administration promises to focus more on social and environmental issues.

Big banks like Bank of America Corp. and JPMorgan Chase & Co. have been responding to these pressures, but now ESG is trending down through the industry. With the right approach, banks may find that these practices actually improve their operations. However, smaller community and regional banks can’t – and probably shouldn’t – merely copy the ESG practices of their larger brethren. “People have to think about what’s appropriate for their bank, given [its] size and location,” says Appelbaum. “What are they already doing that they could expand and beef up?”

That means banks shouldn’t feel pressured to go big or go home when it comes to ESG. Begin with the basics: Has your bank reduced waste by encouraging paperless statements? How many hours do employees spend volunteering in the community? “When you sit down and talk to bankers about this, it’s interesting to see [their] eyes open,” says Brandon Koeser, senior manager and financial services senior analyst at the consulting firm RSM. The pandemic shed light on how banks support their employees and communities. “The reality is, so much of what they’re doing is part of ESG.”

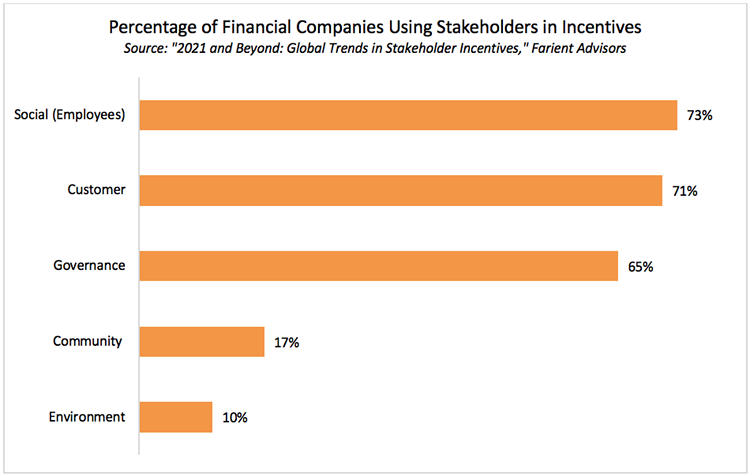

Robin Ferracone, CEO of the consultancy Farient Advisors, tells companies to think of ESG as a journey, one that keeps strategy at its core. “You need to walk before you run. If you try to bite [it] all off at once, you can get overwhelmed,” she says. Organizations should prioritize what’s important to their strategy and stakeholders. ESG objectives should be monitored, revisited and adjusted along the way.

Stakeholders are watching. Glacier Bancorp CEO Randall Chesler was surprised to learn just how closely in a conversation with one of the bank’s large investors two years ago.

“One of our investors asked us, ‘Have you looked at this? We see your score isn’t very good; are you aware of that? What are you going to do about it?’ And that was the first time that we started to dig into it and realized that we were being scored by ISS,” says Chesler. (Institutional Shareholder Services provides an ESG rating on companies, countries and bonds to inform investors.)

It turned out that $18.5 billion Glacier was doing a lot, particularly around the social and governance aspects of ESG. The Kalispell, Montana-based bank just wasn’t telling its story. This is a common ESG gap for community and regional banks.

Glacier worked with consultants to develop a program and put together a community and social responsibility report, which is available in the investor relations section of its website, along with other governance documents such as its code of ethics. This provided the right level of information to lift Glacier’s score. “Our benchmark was, we want to be at our peer-level scoring on ESG,” says Chesler. “[We] ended up actually better. And we continue to watch our scores.”

“Community banks have the social and governance aspects covered better than many industries because [banks are] heavily regulated,” says Joe Scott, a managing director at Kroll Bond Rating Agency. Where they likely lag, he says, is around the environment; most are just beginning to assess these risks to their business. And it’s important that banks get this right as stakeholders increasingly focus on ESG. “We’re hearing that, beyond equity and debt investors, larger depositors – particularly corporate depositors, institutional depositors, state treasurers’ officers [and] others like that – are incorporating ESG into their considerations on who they place large deposits with. That could be a theme over time- other kinds of stakeholders factoring in ESG more and more.”