5 Key Takeaways From the State of Commercial Banking

Brought to you by Q2

In January, Q2 released the 2023 State of Commercial Banking Report, which analyzed data from Q2’s PrecisionLender proprietary database that includes commercial relationships from more than 150 banks and credit unions throughout the United States, along with other sources. Report author Gita Thollesson weighs in on the uncertainty of the 2023 outlook and other key takeaways from the report.

Takeaway 1: All we can say with certainty about the economic outlook for 2023 is that it’s uncertain.

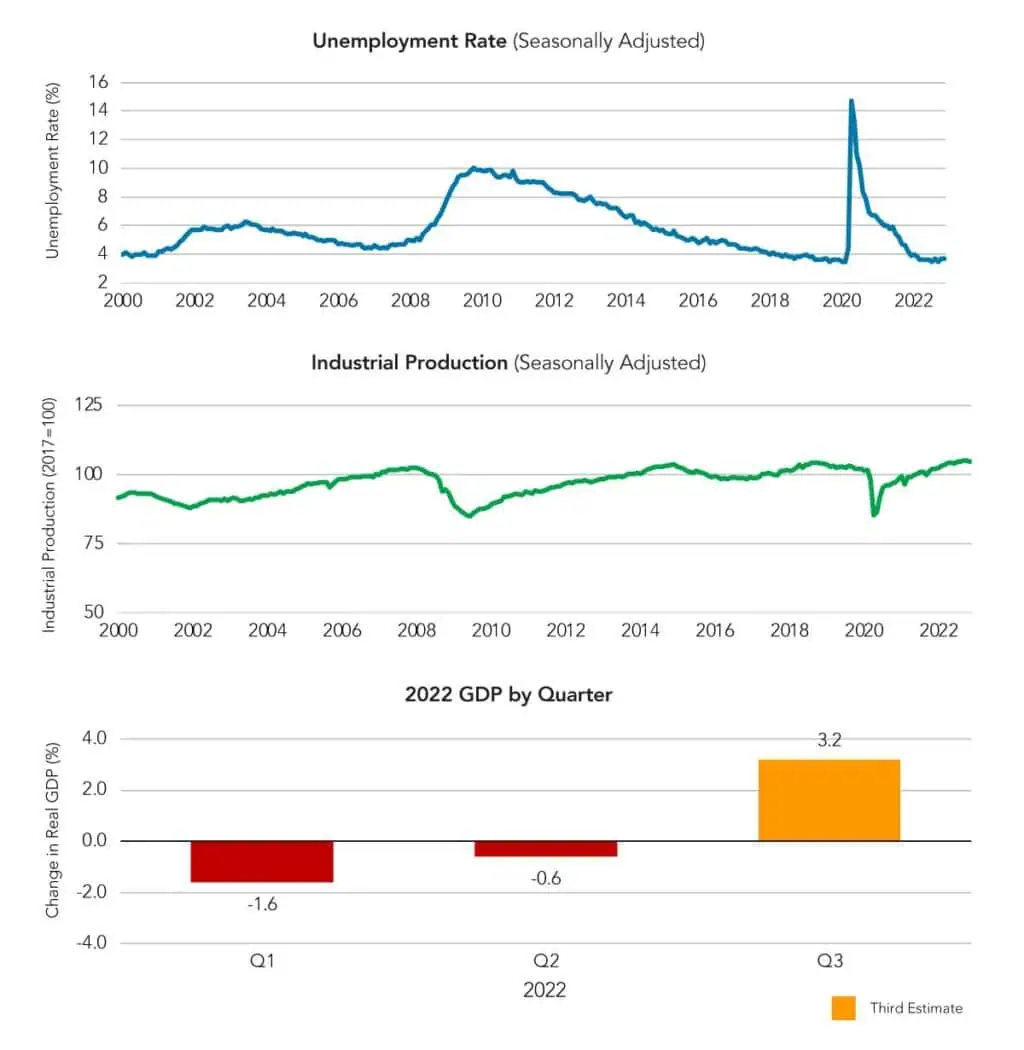

We’re seeing a lot of mixed signals in the market right now. On one hand, gross domestic product, or GDP, went from an actual rate of 5.5% at the end of 2021 to 2.1% by December 2022. Two quarters of negative GDP growth and an inverted yield curve are often two key predicators of recession, and 2022 had both.

On the other hand, the U.S. economy has enjoyed record low unemployment and a strong jobs market, robust industrial production and positive GDP growth in the latter half of 2022. These mixed signals suggest this recession will be different.

Takeaway 2: Banks are bracing for a downturn, but…

There’s wide consensus that there could be an economic downturn. However, bank credit metrics are currently holding strong; although some financial institutions are expecting some deterioration, it hasn’t materialized yet.

Looking at risk metrics in commercial real estate and commercial and industrial lending, delinquency rates are trending lower and charge-offs have fallen off a cliff. Despite that, we’re seeing banks increase their loan loss provisions, which could indicate they’re bracing for rough weather ahead.

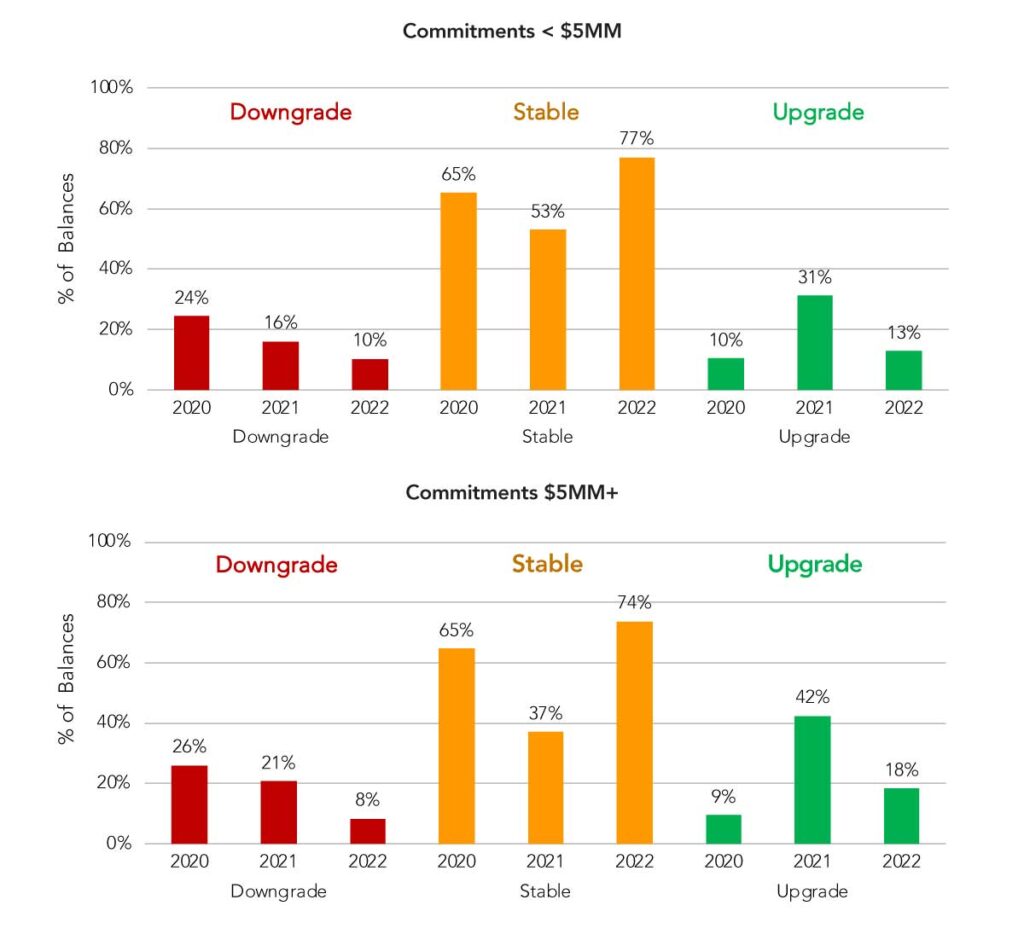

It’s also worth noting that when we look at the probability of default (PD) grades on loans – both below and above $5 million – in our proprietary data, we found a tremendous amount of stability in terms of ratings in 2022. PD grades are often a much earlier indicator of borrower health than delinquencies; the stability suggests that customers are not yet showing signs of weakness.

Takeaway 3: Renewed focus on deposits amid a competitive lending climate.

We’re seeing a tremendous amount of competitive pressure from a pricing perspective. This runs counter to what we typically see at this stage of the cycle: Usually in a pre-recessionary period, banks begin to tighten up, but we’re not seeing that in the data yet.u202fIf anything, spreads are getting narrower.

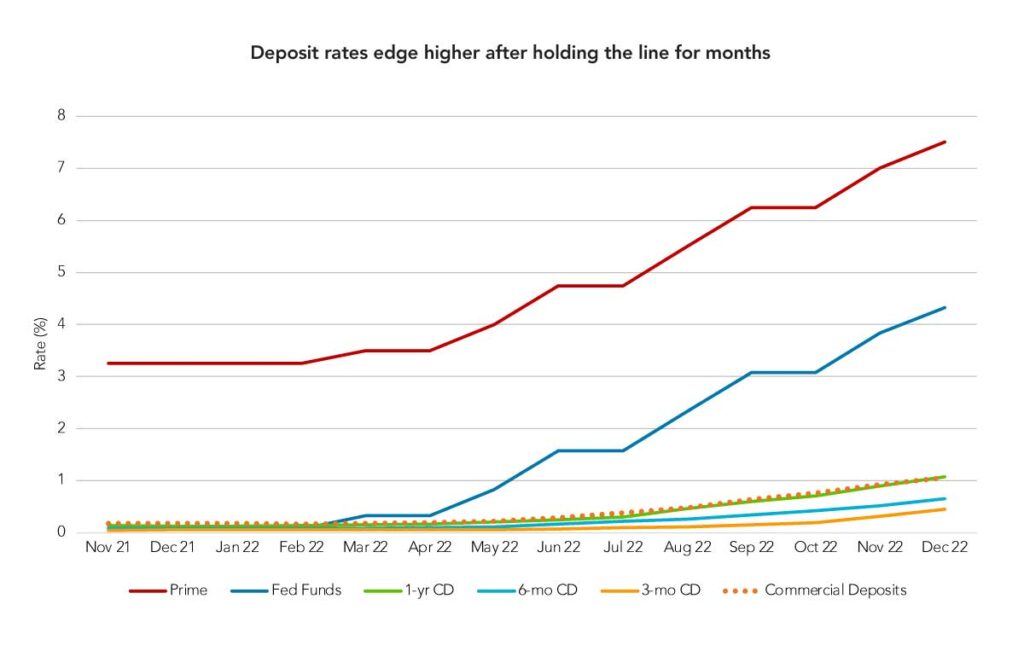

Last year, the industry experienced climbing deposits through mid-year 2022 before balances started to flatten out. The Fed raised rates, but banks didn’t follow suit and deposits started leaving the banking industry, according to weekly data from the Federal Reserve’s H8 releases. By year end, these figures were heading south. Not surprisingly, deposit growth has risen to the top of the strategic priority list for 2023. Banks are raising deposit betas, passing a greater portion of the interest rate increases to customers, especially on commercial accounts to preserve liquidity.

Takeaway 4: Digital reaches deep into the financial institution.

What was once primarily a conversation about the online banking platform has evolved into so much more. We’re now seeing a real focus on the part of financial institutions to center and target their digital spending on client experiences and create internal efficiencies by providing more tools to employees to streamline and automate processes that have largely been manual in the past. Our research finds that these both are two of the top priorities for banks.

Takeaway 5: Payments innovation is leveling the playing field.

We’re also seeing tremendous change on the payments front. Real-time payment rails, which are slated to be the first new rails in 40 years, include a broader payment message set that covers the life cycle of a payment and enables the invoice/remittance data to travel with that payment from start to finish. The changes are leveling the playing field, and the benefits go far beyond the immediacy of the payments. The true value for business is in the remittance data.

Despite technological advancements, adoption has been slow; the industry still needs more financial institutions to get on board. Fortunately, new innovations that leverage the full power of real-time payments rails are set to hit the market in 2023.