77 Percent of Bank Boards Approve Loans. Is That a Mistake?

Bank directors face a myriad of expectations from regulators to ensure that their institutions are safe and sound. But there’s one thing directors do that regulators don’t actually ask them to do.

Bank directors face a myriad of expectations from regulators to ensure that their institutions are safe and sound. But there’s one thing directors do that regulators don’t actually ask them to do.

“There’s no requirement or even suggestion, that I’m aware of, from any regulators that says, ‘Hey, we want the board involved at the loan-approval level,’” says Patrick Hanchey, a partner at the law firm Alston & Bird. The one exception is Regulation O, which requires boards to review and approve insider loans.

Instead, the board is tasked with implementing policies and procedures for the bank, and hiring a management team to execute on that strategy, Hanchey explains.

“If all that’s done, then you’re making good loans, and there’s no issue.”

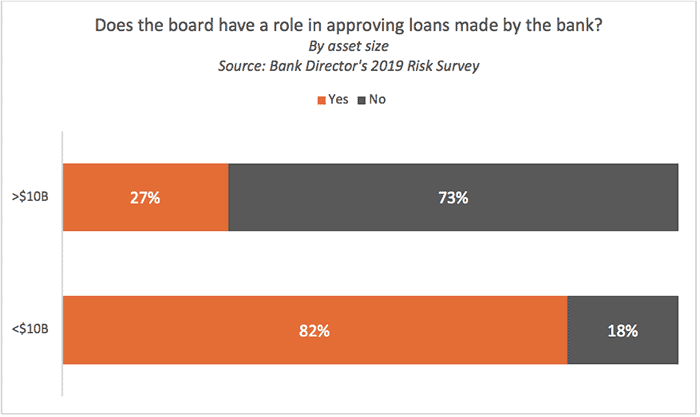

Yet, 77 percent of executives and directors say their board or a board-level loan committee plays a role in approving credits, according to Bank Director’s 2019 Risk Survey.

Boards at smaller banks are more likely to approve loans than their larger peers. This is despite the spate of loan-related lawsuits filed by the Federal Deposit Insurance Corp. against directors in the wake of the recent financial crisis.

The board at Mayfield, Kentucky-based First Kentucky Bank approves five to seven loans a month, says Ann Hale Mills, who serves on the board. These are either large loans or loans extended to businesses or individuals who already have a large line of credit at the bank, which is the $442 million asset subsidiary of Exchange Bancshares.

Yet, the fact that directors often lack formal credit expertise leads some to question whether they should be directly involved in the process.

“Inserting themselves into that decision-making process is putting [directors] in a place that they’re not necessarily trained to be in,” says James Stevens, a partner at the law firm Troutman Sanders.

What’s more, focusing on loan approvals may take directors’ eyes off the big picture, says David Ruffin, a director at the accounting firm Dixon Hughes Goodman LLP.

“It, primarily, deflects them from the more important role of understanding and overseeing the macro performance of the credit portfolio,” he says. “[Regulators would] much rather have directors focused on the macro performance of the credit portfolio, and understanding the risk tolerances and risk appetite.”

Ruffin believes that boards should focus instead on getting the right information about the bank’s loan portfolio, including trend analyses around loan concentrations.

“That’s where a good board member should be highly sensitized and, frankly, treat that as their priority—not individual loan approvals,” says Ruffin.

It all boils down to effective risk management.

“That’s one of [the board’s] main jobs, in my mind. Is the institution taking the right risk, and is the institution taking enough risk, and then how is that risk allocated across capital lines?” says Chris Nichols, the chief strategy officer at Winter Haven, Florida-based CenterState Bank Corp. CenterState has $12.6 billion in assets, which includes a national correspondent banking division. “That’s exactly where the board should be: [Defining] ‘this is the risk we want to take’ and looking at the process to make sure they’re taking the right risk.”

Directors can still contribute their expertise without taking on the liability of approving individual loans, adds Stevens.

“[Directors] have information to contribute to loan decisions, and there’s nothing that says that they can’t attend officer loan committee meetings or share what they know about borrowers or credits that are being considered,” he says.

But Mills disagrees, as do many community bank directors. She believes the board has a vital role to play in approving loans.

First Kentucky Bank’s board examines quantitative metrics—including credit history, repayment terms and the loan-to-value ratio—and qualitative factors, such as the customer’s relationship with the bank and how changes in the local economy could impact repayment.

“We are very well informed with data, local economic insight and competitive dynamics when we approve a loan,” she says.

And community bank directors and executives are looking at the bigger picture for their community, beyond the bank’s credit portfolio.

“We are more likely to accept risk for loans we see in the best interest of the overall community … an external effect that is hard to quantify using only traditional credit metrics,” she says.

Regardless of how a particular bank approaches this process, however, the one thing most people can agree on is that the value of such bespoke expertise diminishes as a bank grows and expands into far-flung markets.

“You could argue that in a very small bank, that the directors are often seasoned business men and women who understand how to run a business, and do have an intuitive credit sense about them, and they do add value,” says Ruffin. “Where it loses its efficacy, in my opinion, is where you start adding markets that they have no understanding of or awareness of the key personalities—that’s where it starts breaking apart.”