From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions.rnrnTo sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

Characteristics of FDIC Lawsuits against Directors & Officers of Failed Financial Institutions

As widely reported in the press, seizures of banks and thrifts by regulatory authorities began to subside in 2011. Throughout the year, 92 institutions were seized compared with 157 in 2010 and 140 in 2009. In contrast, Federal Deposit Insurance Corporation professional liability lawsuits targeting failed financial institutions began to increase in 2011. These are lawsuits in which the FDIC, as receiver for failed financial institutions, brings professional liability claims against directors and officers of those institutions and against other related parties, such as accounting firms, law firms, appraisal firms or mortgage brokers.

Overview

From July 2, 2010, through January 27, 2012, the FDIC filed 21 lawsuits related to 20 failed institutions (two of the 21 lawsuits were associated with IndyMac Bank, F.S.B). Of the 21 lawsuits, two were filed in 2010, 16 in 2011, and three in January 2012. Aggregate damages claimed in the complaints totaled $1.98 billion.

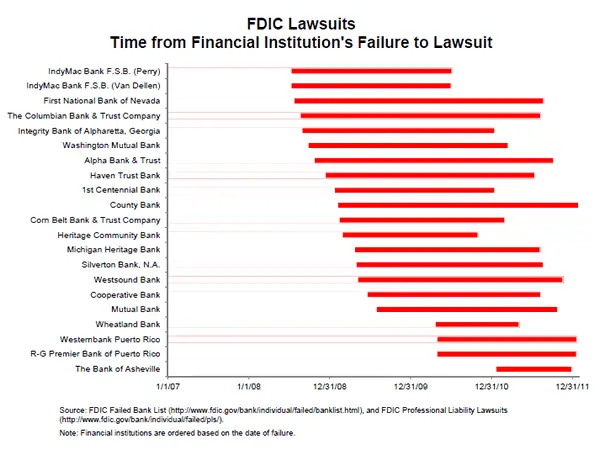

On average, the FDIC waited 2.2 years to file a lawsuit related to a failed financial institution, although the majority of recent FDIC lawsuits were filed more quickly.

On average, the FDIC waited 2.2 years to file a lawsuit related to a failed financial institution, although the majority of recent FDIC lawsuits were filed more quickly.

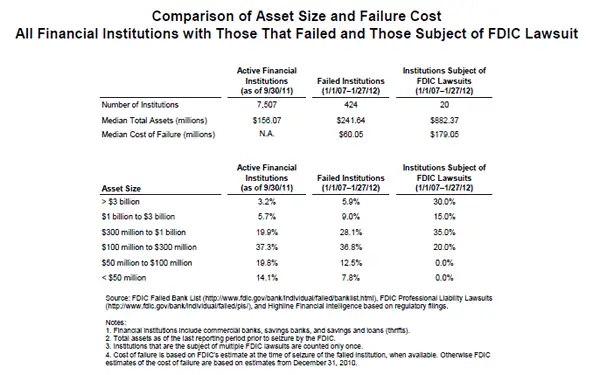

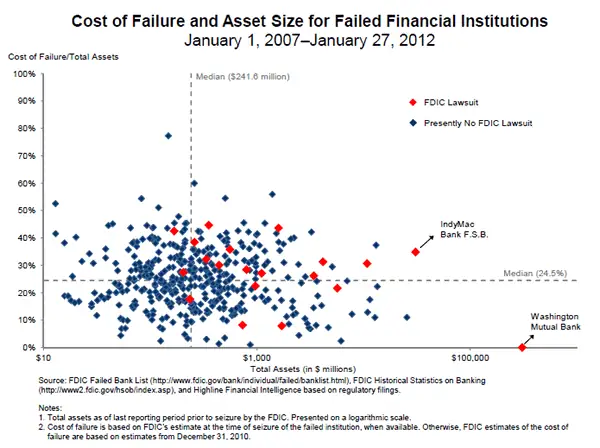

To date, only 4.7 percent of financial institutions that failed since 2007 have been the subject of FDIC lawsuits (20 out of a total of 424 bank failures). These lawsuits have tended to target larger failed institutions. The 20 banks named in lawsuits had median total assets of $882 million compared with median total assets of $241 million for all failed institutions. Furthermore, the 20 bank failures had a median estimated cost to the FDIC of $179 million at the time of seizure. This compares with the median estimated cost of failure of $60 million for all failed banks.

The FDIC lawsuits to date have included those related to the two largest failed institutions (Washington Mutual and IndyMac). However, there are many other large or costly failures that have not yet been the target of FDIC lawsuits. In particular, many of the most costly failures that occurred in 2008 and 2009 have not yet resulted in FDIC lawsuits. Given statute of limitations restrictions, these would seem to be the most likely candidates for FDIC lawsuits in the near future.

Each federal banking regulator was the primary supervisor for at least one of the institutions targeted by an FDIC lawsuit. Among the 20 sued institutions, two were savings associations regulated by the former Office of Thrift Supervision (OTS), two were nationally chartered commercial banks regulated by the Office of the Comptroller of the Currency (OCC), 14 were state-chartered nonmember banks supervised by the FDIC, and two were state-chartered member banks supervised by the Federal Reserve Board.

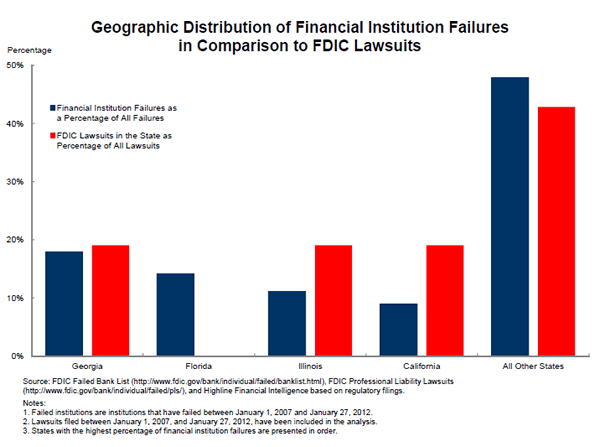

The geographic mix of lawsuits has paralleled the location of failed institutions, with the largest concentrations in Georgia, Illinois and California. One exception is Florida, where a large percentage of failed financial institutions were located (60 banks or 14 percent of all failures since 2007), but where no FDIC lawsuits have been filed to date.

Defendants and Claims

Defendants named in the 21 filed lawsuits included 178 former directors and officers. In six of these cases, only inside directors and officers were named as defendants. Outside directors were named as defendants in addition to inside directors and officers in the remaining 15 lawsuits. CEOs were named as defendants in 18 cases. Other officers commonly named as defendants included CFOs (four cases), chief loan officers (eight cases), chief credit officers (six cases), chief operating officers (four cases), and a chief banking officer (one case). In addition, three lawsuits named insurance companies as defendants, and one case identified a law firm as a defendant. Three cases also included spouses of the directors and officers as named defendants.

Allegations of negligence, gross negligence, and breach of fiduciary duty were made in 19, 18, and 18 of the lawsuits, respectively.

Damages Claimed

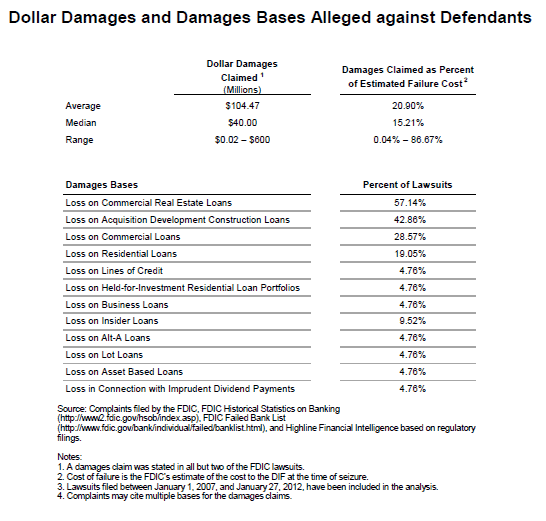

In 19 of the 21 complaints, the FDIC explicitly claimed damages amounts ranging from $20,000 to over $600 million. The average and median damages claims were $104 million and $40 million, respectively.

Losses on commercial real estate (CRE) loans and acquisition, development and construction (ADC) loans were the most common bases for alleged damages. Twelve of the complaints identified CRE loans as a basis for the damages claim and nine identified ADC loans as a basis. Despite the widespread problems in residential lending and residential real estate markets, fewer lawsuits focused on those types of lending.

Settlements

Settlements

As of January 27, 2012, three of the 21 lawsuits have settled. FDIC as Receiver of Corn Belt Bank and Trust Company v. Stark et al. settled on May 24, 2011, with settlement details remaining undisclosed. FDIC as Receiver for First National Bank of Nevada v. Dorris and Lamb, which claimed damages of $193 million, settled on October 13, 2011, with the two officer and director defendants each agreeing to pay $20 million. Most recently, FDIC as Receiver for Washington Mutual Bank v. Killinger et al. agreed to settle with three former executives agreeing to pay $64 million in total.

Final Note

These findings do not include the many negotiations and mediation discussions the FDIC has undertaken with officers and directors of failed institutions. Statistics for these activities are unavailable. The number of lawsuits filed has yet to approach the numbers authorized by the FDIC. As of January 18, 2012, the FDIC has authorized lawsuits in connection with 44 failed institutions against 391 individuals, claiming damages of at least $7.7 billion. The difference suggests that more lawsuits may be filed before long.

You have accessed a resource that is only available to our Bank Services members.

Read The Article

Please enter your username and password bellow. If you have established a password please click ‘forgot your password’

You have accessed a resource that is only available to our Bank Services members.

From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions.rnrnTo sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

Read The Article

Please enter your username and password bellow. If you have established a password please click ‘forgot your password’