Juliet is the Chief Experience Officer at Adrenaline, leading brand experience for the company and our clients, exemplifying Adrenaline’s focus on leveraging brand experience to help financial institutions grow.

How Banks Can Capitalize on Their Branch Networks

A financial institution’s branch network is their greatest investment and opportunity for growth. Learn how banks are making the most of their retail banking locations.

Brought to you by Adrenaline

Banks are going all in on their retail channels, as PNC Financial Services Group’s recent announcement of a new $500 million investment shows. But just how much benefit do banks gain from their branches? Even as digital transactions soar, financial institutions still rely on their branch networks to attract customers.

In an era where competition is fierce from banking giants and fintech companies, financial institutions face a pivotal choice: Adapt and leverage their unique advantages or risk losing their foothold. Amid this evolving landscape, one powerful asset remains resilient — the local branch.

Once seen as a relic of traditional banking, the branch is making a bold comeback, reestablishing itself as the cornerstone of customer acquisition and loyalty. Branches aren’t just buildings, they’re where banking relationships begin, deepen and thrive. According to a recent Adrenaline report the branch is home to nearly three-quarters of new-to-bank sales, and consumers use branches more than any other channel to open accounts and get advice.

However, branches must evolve for banks to realize their full potential.

In “The Branch Advantage,” Adrenaline evaluated bank and credit union branch transformation success. The report uses key qualitative and quantitative measures and includes a survey of clients that have invested in branch updates over the last decade, as well as industry research of institutional performance following an investment in the branch banking channel. If institutional uplift is the driver for branch investment, just how much growth are banks unlocking?

The data reveals that banks and credit unions that invested in their branch networks yielded stronger returns and grew faster than the financial services sector at large. In aggregate, branches that had been transformed through design and construction outgrew the market in terms of deposit growth, with a 2.3% return on investment. Banks investing in branches outpace the industry, but individual institutions also report greater growth.

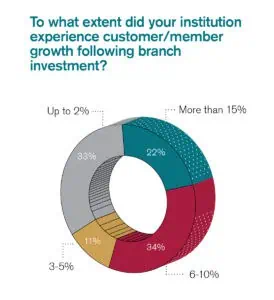

When surveyed, more than one-third of financial institutions grew their customer base between 6% and 10% after investing in branch improvements, and more than one-fifth saw even greater success, generating more than 15% customer or member growth compared to an annual average of 3.3% in the industry. Not only does a bank or credit union’s brand strength grow after investing in their branch network, but individual updated branches lead to new opportunities in the market.

Responding to market potential, VeraBank updated its existing branches while expanding into new markets.

Following a 2018 acquisition, the Texas bank launched the new VeraBank brand the following year, sparking a wave of renovations to align its branches with the updated brand. The community banking leader has seen a 154% return on investment across the branch network, transformed 70% of its current branch footprint and realized a 93% reduction in teller transactions, which has freed its staff to develop higher-value customer relationships.

“We really do believe that a well-transformed branch is a billboard,” Woodie Tipps, VeraBank’s executive vice president and chief retail officer, said. “It is a beacon out there to attract new customers.”

Another bank leveraging their network for success is Mississippi-based Guaranty Bank. With a focus on growth, the bank modernized its brand in 2018 and rolled out a fresh banking experience into branches. Their branch updates position them to meet next-generation banking customers and set the stage for continued growth into opportunity markets. About 20% of Guaranty’s network is designed as advice centers with teller cash recyclers (TCRs) and cash bars in areas with greater advisory opportunities. The branch experience supports market impact and a reduction of full-time equivalents (FTE) has improved efficiencies.

Hue Townsend, Guaranty Bank & Trust’s chief executive officer, shares his advice for other institutions. “You have to make a plan and move forward, knowing it is going to pay dividends. It’s good for your culture; it’s good for the customer. The cost takes care of itself, once you get it done.”

The branch represents the largest institutional investment that most banks and credit unions will make, and the needs to enhance the experience are ongoing. Building a holistic strategy for retail delivery is foundational to success across the branch network. The process of branch change also requires internal investment via coordination and collaboration of multiple stakeholders across the organization.

Branch changes provide a significant edge for institutional efficiency and customer experience. For banks and credit unions embracing more transformational change, the branch delivery channel benefits from a renewed purpose and provides organizations with a powerful platform for future opportunity and growth.