Laura Alix is the Director of Research at Bank Director, where she collaborates on strategic research for bank directors and senior executives, including Bank Director’s annual surveys. She also writes for BankDirector.com and edits online video content. Laura is particularly interested in workforce management and retention strategies, environmental, social and governance issues, and fraud. She has previously covered national and regional banks for American Banker and community banks and credit unions for Banker & Tradesman. Based in Boston, she has a bachelor’s degree from the University of Connecticut and a master’s degree from CUNY Brooklyn College.

How to Build Engagement on a Diverse Board

Developing strong corporate governance policies, such as offering a mentorship program for new board members, can help ensure all directors feel comfortable participating in discussions.

By her own admission, Kimberly Ellwanger might have been considered the token woman when she first joined the board of Heritage Financial Corp., in 2006.

Ellwanger’s credentials as a director spoke for themselves: She worked as senior director of corporate affairs and associate general counsel for Microsoft Corp. before retiring in 1999 and served on several nonprofit boards before joining the holding company for Heritage Bank in Olympia, Washington. But Ellwanger was still replacing the outgoing sole woman on the board.

“There is a different feeling when you’re a lone woman on the board,” she says. “That changed when we added first, one other woman and then a third woman.”

Today, Ellwanger is one of five women, out of 11 directors in total, serving on the board. When there are more women on a board, individual directors may be less nervous about being the lone voice on a particular issue, Ellwanger says. She believes this likely holds true for any type of diversity, including age, experience or ethnicity.

“Once you have a more diverse board, I think the board itself just becomes more open to hearing new ideas, and to acting on those ideas,” she says.

Research by Ann Owen, an economics professor at Hamilton College and former Federal Reserve economist, supports the idea that it’s not enough to merely have one woman on the board. Owen’s work finds that banks benefit from having gender diversity in the boardroom, but only when there are at least two women on the board and when the bank is otherwise well managed.

Owen theorizes that when there is more than one woman serving on a board, gender becomes a less salient and defining characteristic for those directors. Consciously or not, the board as a whole may be less likely to see their gender and more likely to see the qualifications they bring to the group.

Findings from Bank Director’s 2024 Governance Best Practices Survey suggest that women’s experiences differ somewhat from men’s in boardroom deliberations.

The survey found that men were more likely to say that they speak more than the average board member, while women were more likely to say they speak as much as the average board member. Women were also slightly less likely to say their input is usually well received and they were less likely than men to believe that all directors contributed to deliberations.

Strong corporate governance policies, particularly around onboarding of new directors and improving engagement, can help ensure that all directors are fully participating.

Disengagement can happen at any point during a director’s tenure, and it’s important to get to the root causes if this occurs, says Alan Kaplan, founder and CEO of the executive search and board advisory firm Kaplan Partners. Performance assessments of both the board as a whole and individual directors can be a valuable tool for initiating conversations about how directors might improve their participation, he says.

While corporate policies concerning diversity, equity and inclusion have come under greater scrutiny this year, the banks that Kaplan works with have not indicated any intention of backing off from seeking diverse board talent. Board engagement is important regardless of board composition, he adds.

“If you’re on the board you need to be fully engaged,” Kaplan says. “A board seat is a rare and precious thing and everybody needs to contribute in some meaningful way.”

Ellwanger, who chairs the nominating and governance committee at $7 billion Heritage, says the person leading a given discussion, like the board or committee chair, should also take some responsibility for encouraging participation.

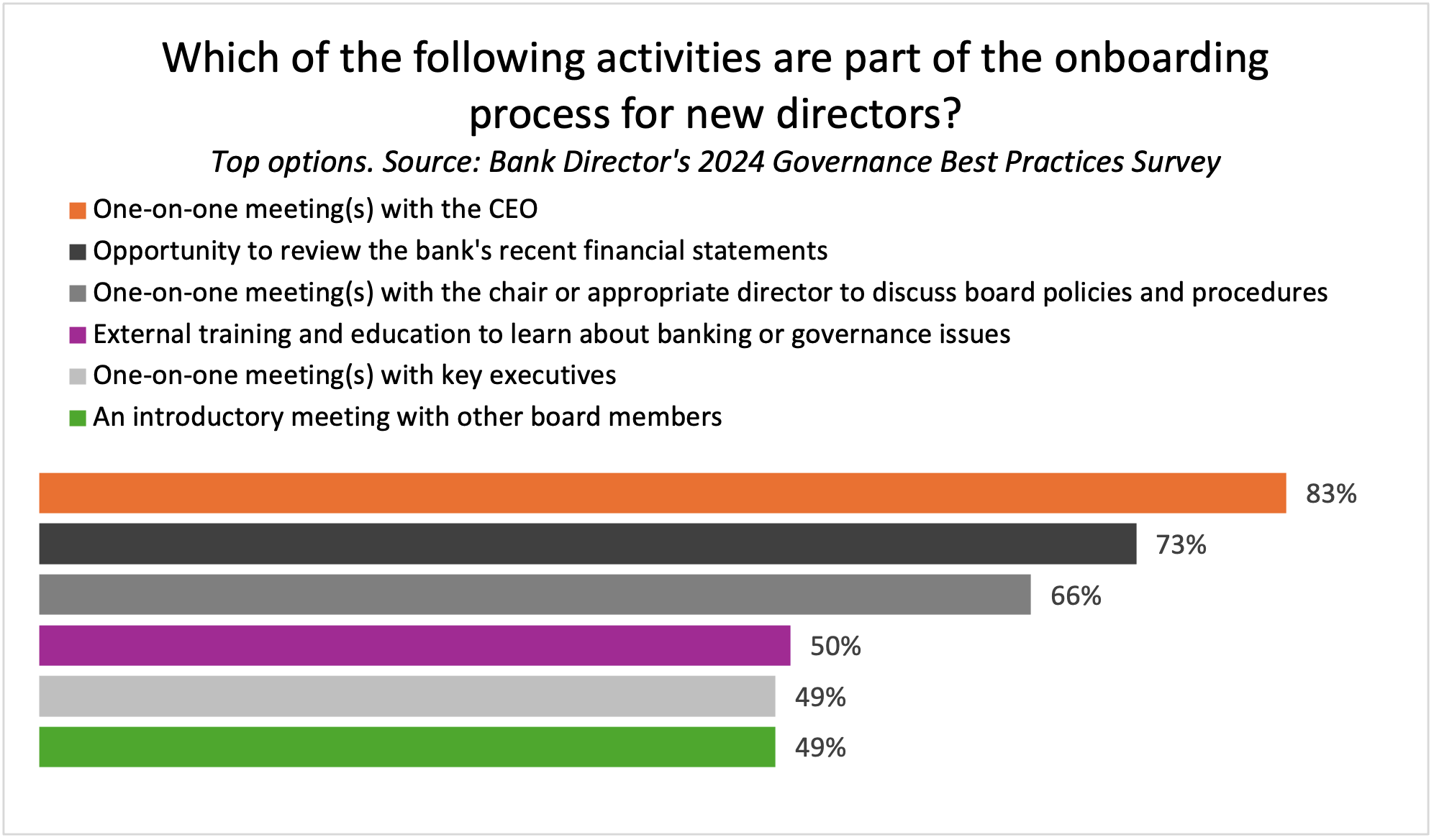

While most boards have an onboarding process that includes some type of one-on-one time with management and other directors, Kaplan believes there’s always room for improvement.

“It’s underappreciated,” he says of the onboarding process. “A lot of directors have said to me over the years, ‘Wow, it took me 12, 18, 24 months until I really got up to speed and understood banking, or what it means to be a public company director.’”

He believes that more boards could benefit from implementing a mentorship program for new directors in their first year, something that Ellwanger describes as critical to the onboarding process at Heritage. Just 21% of respondents to the survey say their onboarding process includes a mentorship practice.

“It’s great for the new person to have that one-on-one opportunity to ask questions about anything that came up in the board meeting that maybe he or she didn’t understand,” she says. “That really helps the person just become more deeply engaged, more quickly.”

Heritage also provides incoming directors with digital onboarding materials, including all basic corporate governance documents and policies, and meeting minutes from the prior year. It also facilitates introductions with executives, meetings with committee chairs and hosts a welcome dinner with other directors.

Owen says her work ought not to be construed as a reason to avoid adding women directors if a board does not already meet certain conditions. Rather, she sees it as a call to cultivate the kind of board environment that can benefit from a variety of voices and healthy dissent.

“There is some talent involved in extracting the best from a diverse group, and I would say you should work on developing those skills generally for the management of your board and for all kinds of people,” Owen says. “There are very few situations now in which you cannot interact with people who are different from you.”