What if Amazon Offered a Checking Account?

Amazon Prime, Video, Music, Fresh, Alexa—all loved by many, but would consumers also care for an Amazon checking account? One recent survey says that, yes, a subscription based, value-added checking account is the best thing since free two-day shipping.

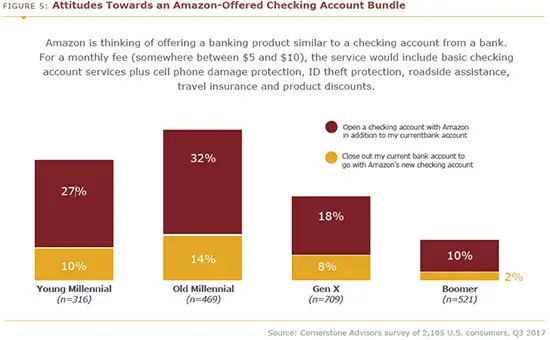

In a study conducted by Cornerstone Advisors, consumers were asked about their banking attitudes and behaviors and presented with this account option:

“Amazon is thinking of offering a checking account. For a fee of $5-10 a month, the service will include cell phone damage protection, ID theft protection, roadside assistance, travel insurance and product discounts.“

Forty-six percent of “Old Millennials” (ages 31-38) and 37 percent of “Young Millennials” (ages 22-30) say they would open that account. Of those who say they would open the account, almost a quarter say that they would close out their existing checking accounts—most likely with a traditional bank.

When the same responders were asked about a free checking account from Amazon, without the bundled services, interest in opening the account is lower.

“This is music to Amazon’s ears,” says Ron Shevlin, Director of Research at Cornerstone Advisors. “Why would they want to offer a free checking account when they can bundle the services of various providers on their platform—merchants and financial services providers—and charge a fee for it. A fee that consumers are willing to pay for.”

When asked about the hypothetical Amazon account stated above, 73 percent of 30-somethings say they would definitely switch or would consider switching accounts if their primary financial institution offered a checking account with those valuable services. Sixty-four percent of 20-somethings said the same.

Which of the age segments has the most fee based accounts—millennials, Gen Xers or boomers?

About three in four (77 percent) of all survey respondents have a free checking account. Of the millennial segments, 31 percent have a fee-based account. That number is actually less among Gen Xers and boomers—22 percent of Gen Xers are in a fee-based checking account, and boomers report in at only 12 percent.

As loyal users of subscription services, millennials are accustomed to—and willing to pay for—value in order to get something valuable in return. They recognize that you usually get what you pay for, so what you get for free probably isn’t worth much. Even worse, many associate free accounts with the fine print fees you’ll inevitably end up with anyway. And customer reviews on hidden fees will always be 0 out of 5 stars.

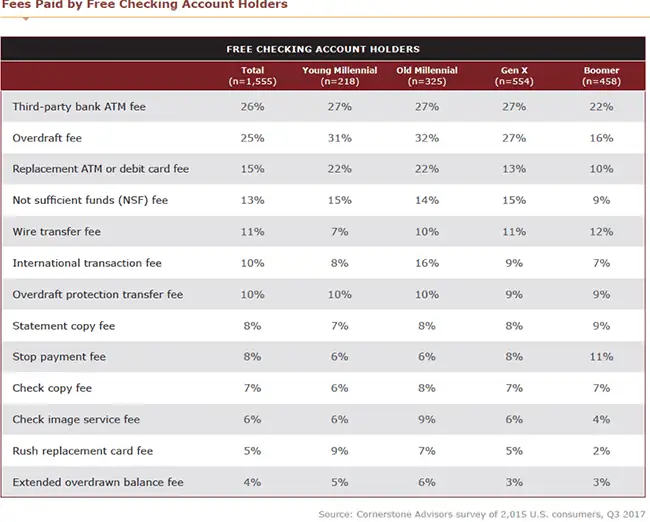

Turns out, among those surveyed with a free checking account, nearly every account holder paid at least one fee in the prior year.

Recommended for You

When survey respondents were asked how many friends and family they have referred to their primary FI over the past year, results show that more people with fee-based checking accounts are referring their primary FI than those with free checking accounts. This is true across each generational segment as well as each type of institution (megabank, regional bank, community banks and credit union). Plus, they grew their relationship by adding non-deposit products.

“Among fee-based account holders, 58 percent referred friends/family, and 43 percent added non-deposit products,” says Shevlin. “In contrast, among free checking account holders, 44 percent referred friends/family, and just 27 percent added non-deposit products.”

In short, the results of customers’ relationships with fee-based accounts are positive, for them and the bank:

- Nearly half of the millennial age segment say they’d opt for a fee-based account with value added services from Amazon.

- Less say they’d open a free account from Amazon.

- Almost 75 percent would at least consider switching accounts if their primary FI offered this same Amazon-type checking account.

- Millennials beat Gen Xers and boomers in having the most fee-based accounts.

- More people in fee-based accounts are referring their bank than those in free accounts.

According to Shevlin, “The prescription for mid-size banks and credit unions is simple: Reinvent the checking account to provide more value to how consumers manage their financial lives.”

For more insights about how to reinvent your checking accounts and thrive in the subscription society, download Shevlin’s free white paper, commissioned by StrategyCorps, at strategycorps.com/research.