Do You Have Effective Incentive Plans for Your Commercial Lenders?

Commercial banking is a core business for most regional and community banks. It is a key driver of profitability as well as organizational growth, and frequently serves as the entry point to many of the bank’s other businesses, such as wealth management, treasury services and deposit gathering. The competition for talent and growth within commercial lending has never been higher, and as a result, commercial lenders continue to be among the mostly highly paid and highly incentivized individuals in the bank. It is of critical importance therefore to think carefully about maximizing your bank’s return on its lender compensation by thoroughly evaluating your incentive programs for this group. Do the plans motivate the right behaviors, properly consider risk elements and successfully align compensation with performance?

Commercial banking is a core business for most regional and community banks. It is a key driver of profitability as well as organizational growth, and frequently serves as the entry point to many of the bank’s other businesses, such as wealth management, treasury services and deposit gathering. The competition for talent and growth within commercial lending has never been higher, and as a result, commercial lenders continue to be among the mostly highly paid and highly incentivized individuals in the bank. It is of critical importance therefore to think carefully about maximizing your bank’s return on its lender compensation by thoroughly evaluating your incentive programs for this group. Do the plans motivate the right behaviors, properly consider risk elements and successfully align compensation with performance?

Incentive Goals

The first step in evaluating the effectiveness of the incentive plan for the commercial lending group is evaluating the business priorities of the lending group.

- What is the preferred balance between profit and growth for each of the commercial businesses?

- How should your business segmentation impact your plan design? For example, does the bank need multiple incentive plans to align with segmentation between C&I and commercial real estate, or one incentive plan covering multiple loan types?

- What are the cross-selling or referral expectations for lenders?

- What products and behaviors should your lenders pursue in order to encourage sticky relationships with your commercial clients?

- What is the performance culture of the commercial lending group, and how can the incentive plan reinforce it?

- What are the bank’s goals for specific types of commercial business in terms of client type, industry and loan size? For example, if the bank prioritizes C&I loans due to their typically higher level of fee income and associated deposits, rather than larger CRE loans, the incentive plan should reflect that priority.

These are just a few examples of the types of questions that bank board members and executives should be asking right now as they evaluate their commercial lender incentive programs. In order to properly contribute to the bank’s overall success, the incentive plan design and performance goals must reflect the bank’s priorities for the commercial lending group.

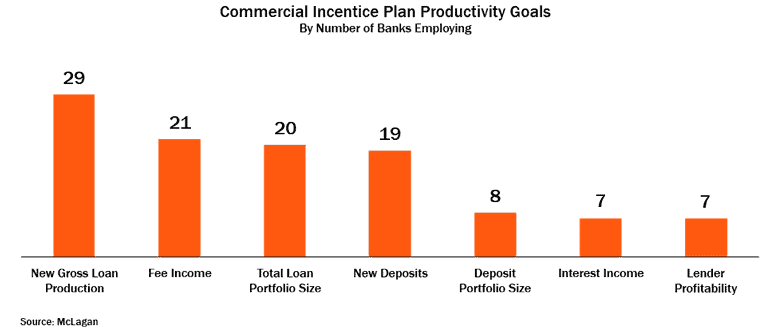

The exhibit below highlights some of the most common productivity goals used for commercial lenders at regional and community banks. Data is taken from a flash survey of regional and community banks that was conducted by McLagan earlier this year and that covered a variety of commercial lending topics.

Aligning Pay With Performance

In addition to identifying plan goals vis-à-vis departmental priorities, it is important to evaluate the alignment of incentive awards with the performance necessary to earn those awards. In short, what is the bank’s return on its incentive payments to lenders? If performance and awards are not appropriately aligned, the bank may be overpaying for mediocre performance or not appropriately rewarding its high performers, either of which can have a negative impact on long-term corporate performance.

Robust performance and payout modeling is particularly important when a new or revised incentive program is implemented—changes to plan payout methodologies may necessitate changing performance expectations for lenders. For example, if incentive payout targets are increased in order to remain externally competitive, do performance targets need to increase as well in order to provide an appropriate return to the bottom line?

Risk Considerations

While lender productivity generally has the biggest impact on plan awards, incentive plans cannot ignore risk considerations. The actions of commercial lenders today can have a significant impact on the bank’s credit quality and profitability in future years, and incentive plans should be designed to mitigate any behaviors that are not in line with the bank’s risk policies. In some cases, risk factors may be included as specific objectives under the incentive plan. More frequently, mechanisms outside of the core plan are used to safeguard against risky behaviors or poor risk outcomes. Common plan mechanisms include credit quality payout triggers, clawbacks that seek to recapture pay that has already been awarded, and deferrals that pay out based on long-term risk outcomes, among others.

In summary, commercial lenders can have a significant impact on your bank’s organizational success, and your commercial incentive plan can have a significant impact on the business and behaviors that your lenders pursue. As you begin to plan for 2018, take time now to evaluate the alignment between goals and business needs, payouts and performance, and plan features and risk policies. Doing so will help your bank maximize the potential organizational impact of its commercial incentive dollars.