Poll: Price Remains Obstacle to Deals

Brighter days are ahead for community banking, according to 68 percent of the more than 200 bank CEOs, board members and senior executives participating in a series of audience surveys at Bank Director’s Acquire or Be Acquired conference, held January 25-27, 2015, in Scottsdale, Arizona. The annual event, which focuses on bank mergers and acquisitions, was attended by more than 520 financial executives and board members, primarily bank CEOs and board members, representing more than 300 banks, the majority of which are headquartered in the central United States. Two-thirds of attendees represented banks with less than $1 billion in assets.

The crowd at the event revealed a strong focus on acquisition opportunities, with 60 percent indicating that their bank will most likely buy another financial institution in 2015, and 16 percent indicating plans to sell. The audience revealed a greater likelihood to participate in M&A in 2015 than the banking community as a whole: Bank Director’s 2015 Bank M&A Survey, conducted in September 2014 and sponsored by Crowe Horwath LLP, found that 47 percent planned to buy, and just three percent to sell, this year.

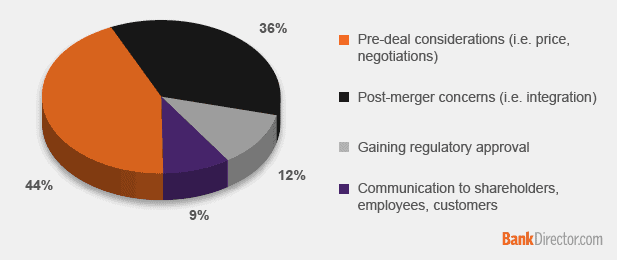

When asked about the biggest barrier for banks seeking an acquisition in today’s market, attendees cited high price expectations on the part of the seller, at roughly one-third. Attendees were also asked which part of the M&A cycle worries them most: 44 percent cited pre-deal considerations, including price and negotiating the deal. This trumps post-deal concerns, such as integration, cited by 36 percent of attendees.

Thirty-four percent said that many targets don’t want to sell, underscoring that confident spirit that brighter days are ahead. Potential sellers may be willing to wait it out for a higher price. While the vast majority of the audience expressed confidence that they understand the value of their bank, 40 percent revealed they are not confident that their board knows what the bank is worth.

On stage at the event, Rick Childs, a partner in Crowe Horwath’s financial advisory services group, said that price and an unwillingness to sell on the part of the target bank really fit hand-in-glove. Many banks don’t want to sell because they expect a high price. High dollar deals—those with pricing about 2.5 times tangible book value—receive a lot of attention, but “there’s a big chunk of deals that get done for less than tangible book value,” said Childs. The expectations of board members and shareholders may not align with those of the market.

There may be more buyers than sellers, but it’s not entirely a seller’s market. A track record of growth and profitability make for a more attractive seller. Almost half of the audience at Acquire or Be Acquired revealed that their primary reason to make an acquisition is to increase earnings per share. Childs said that investors have shifted focus to earnings potential, as opposed to worrying about tangible book value dilution as much, representing a positive step for the industry. Earnings are improving for banks, and targets are more attractive. “I think it’s the right focus to have on deals these days,” he said.

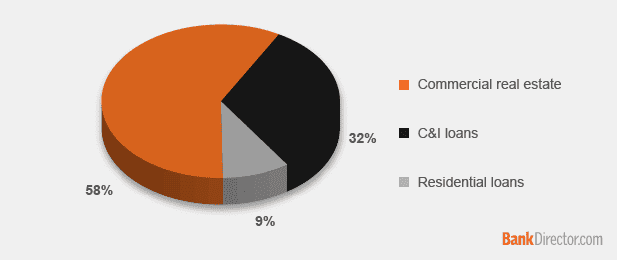

So how do you grow if your bank can’t find the right target at the right price? Not surprisingly, given the audience, 82 percent of attendees said that lending is the primary path to growth for their organization. The best opportunities for loan growth are in commercial real estate, according to 58 percent of attendees. Almost one-third cited commercial & industrial (C&I) lending, and 9 percent cited residential loans.

Commercial real estate loans have been steadily rising since the fourth quarter 2012, according to the Federal Reserve Bank of St. Louis, following a steep decline beginning in the fourth quarter 2008. C&I lending experienced a similar fall, but recovered more quickly. Recovery in the residential loan market has been unsteady.

Childs told the crowd that he sees pockets of the country where lending is picking up, as companies that were forced to live within their means during lean years look to expand and invest in their businesses. But demand hasn’t picked up everywhere. Almost half of the audience said that, aside from regulatory costs, constraints on loan growth, including weak demand, have the most negative impact on the profitability of their institution.