When the Gloves Come Off

Shareholder lawsuits are relatively common for the banking industry, but the reverse—a bank suing one of its shareholders—is fairly unique. On October 31, 2017, Nashville, Tennessee-based CapStar Financial Holdings, with $1.3 billion in assets, sued its second-largest shareholder, Gaylon Lawrence Jr. The bank alleges that the investor and his holding company, The Lawrence Group, violated the Change in Bank Control Act, which requires written notice and approval from the Federal Reserve before owning more than 10 percent of a financial institution, as well as a related Tennessee law. CapStar also maintains that Lawrence violated the Securities Exchange Act of 1934 by failing to disclose plans to acquire additional CapStar stock.

Shareholder lawsuits are relatively common for the banking industry, but the reverse—a bank suing one of its shareholders—is fairly unique. On October 31, 2017, Nashville, Tennessee-based CapStar Financial Holdings, with $1.3 billion in assets, sued its second-largest shareholder, Gaylon Lawrence Jr. The bank alleges that the investor and his holding company, The Lawrence Group, violated the Change in Bank Control Act, which requires written notice and approval from the Federal Reserve before owning more than 10 percent of a financial institution, as well as a related Tennessee law. CapStar also maintains that Lawrence violated the Securities Exchange Act of 1934 by failing to disclose plans to acquire additional CapStar stock.

Passing the 10 percent ownership mark without the proper approvals is more common than one might think, according to Jonathan Hightower, a partner at the law firm Bryan Cave LLP. And often the violators of these rules are directors who are simply enthusiastic about their bank’s stock and want more of it. “They’re interested in the bank. They may know of shares that are available in the community and buy them up without realizing they’ve crossed the threshold where they need regulatory approval,” says Hightower.

How the Fed interprets these regulations and the steps required of shareholders is a specialized area, adds Hightower. “Given that, the Fed’s approach, assuming there’s not an intentional violation, is more permissive than might be expected.” The Fed is unlikely to levy penalties against a shareholder acting in good faith.

Lawrence filed a motion to dismiss the lawsuit on November 13, 2017, and maintains that he has complied where necessary and that, as an individual investor, the Tennessee code requiring a bank holding company to acquire control of the bank isn’t relevant.

What’s unique in the CapStar case is that it’s the bank taking action against the investor, rather than the regulator. In a letter dated November 20, 2017, CapStar asked the Fed to reject Mr. Lawrence’s stake in the bank and require that Lawrence divest “all illegally acquired CapStar shares,” in addition to a request for a cease-and-desist order and the levying of civil money penalties against Lawrence.

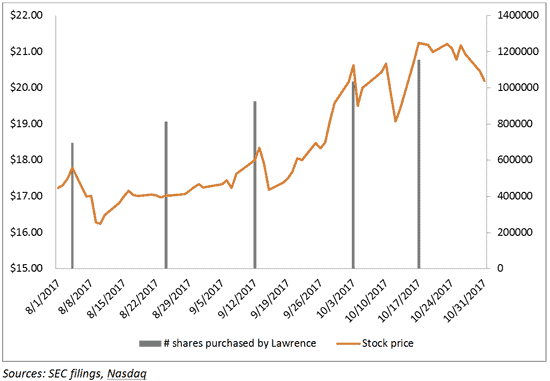

Requiring Lawrence to divest will likely harm what is, in CapStar’s own words, a “thinly traded” stock, according to Stephen Scouten, a managing director at Sandler O’Neill + Partners. Without Lawrence’s acquisitions of large amounts of stock, “the stock would be appreciably lower than it is today,” says Scouten. The stock price rose 6.95 percent year-over-year as of November 27, 2017, and 17 percent in the three months in which Lawrence has been accumulating a sizeable number of shares.

Filings by CapStar indicate that Lawrence attempted to acquire the bank in the summer of 2016. When that attempt was unsuccessful, CapStar alleges that Lawrence approached two of the bank’s largest stockholders to buy their combined 30 percent stake. That attempt also failed, and Lawrence began acquiring CapStar stock on the open market after the bank’s initial public offering last year. From August through October 2017, Lawrence rapidly increased his stake in CapStar from 6.2 to 10.2 percent, paying a total of $82.7 million for 4.6 million shares. CapStar alleges that Lawrence has “coveted control” of CapStar, and it’s easy to see how the bank arrived at that conclusion.

Lawrence is a long-term investor who appears to like what he sees in the Nashville market. He even recently purchased a home there. He’s certainly an experienced bank investor. He owns seven community banks, including two in the Nashville area: F&M Bank, with $1 billion in assets, and Tennessee Bank & Trust, formerly a division of $510 million asset Farmers Bank & Trust in Blytheville, Arkansas, which is also owned by Lawrence. “He’s got a lot of money to put to work, [and] he thinks banks are a good investment for his capital,” says Scouten. Right now, that looks to be as much as 15 percent of CapStar. Whether that turns into a full-fledged bid for the bank, as he sought in 2016, is anyone’s guess. Bank Director was unable to reach a representative of Gaylon Lawrence Jr., and CapStar CEO Claire Tucker declined to comment.

Bank boards frequently deal with active investors, and in most cases, Hightower recommends focusing on shareholder engagement and ensuring that large investors understand the broad strokes of the bank’s strategic plan. “More often than not, it’s people not understanding what they’ve invested in, and where it’s going,” he says.