A Multifaceted Approach to Managing CRE Concentration Risk

Concentration risk is drawing scrutiny from financial regulators, who are focusing on lenders’ commercial real estate (CRE) concentrations. Financial services organizations are responding to this by looking for ways to improve their CRE risk management and credit portfolio management capabilities.

Lending institutions with high CRE credit concentrations and weak risk management practices are exposed to a greater risk of loss. If regulators determine a bank lacks adequate policies, credit portfolio management, or risk management practices, they may require it to develop more robust practices to measure, monitor, and manage CRE concentration risk.

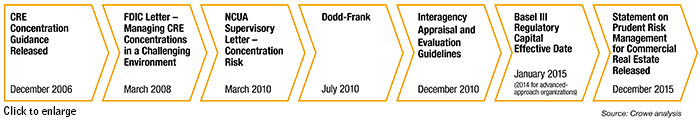

For several years, federal regulatory agencies have issued updated guidance to help banks understand the risks. In 2006, the Federal Reserve, the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency issued a guidance related to CRE concentrations followed by a statement in 2015 titled “Statement on Prudent Risk Management for Commercial Real Estate Lending.” Noting that CRE asset and lending markets are experiencing substantial growth, the 2015 guidance pointed out that “increased competitive pressures are contributing significantly to historically low capitalization rates and rising property values” and said “many institutions’ CRE concentration levels have been rising.”

Since the 2006 guidance, additional regulatory publications related to CRE concentrations have been released. The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) in 2010 began a shift, as banks with less than $10 billion in assets were exempt from more stringent requirements, according to a Crowe timeline analysis.

Looking forward, the 2020 transition to the current expected credit loss (CECL) model for estimating credit losses will likely affect loan portfolio concentrations as well.

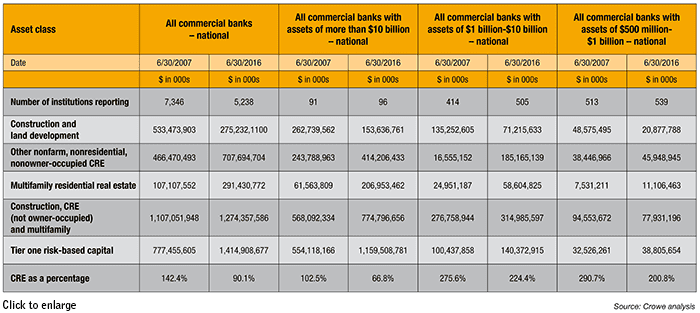

At the community bank level, CRE concentrations have been increasing. In 2016, CRE concentrations in smaller organizations had reached levels similar to mid-2007, according to Crowe’s analysis.

These trends led regulators to sharpen their focus on CRE concentrations.

In one Crowe webinar earlier this year, 76 percent of the participants said their banks had some concern over how to better mitigate the risks associated with growing CRE concentrations.

In addition, 77 percent reported they received feedback within the past two years from regulators or auditors about CRE concentrations. The number of banks concerned about CRE concentration growth will likely continue to rise.

Approach to CRE Concentration Risk

The most effective methods for addressing concentration risk involve an integrated, holistic approach, which encompasses four steps:

- Validate CRE data. Banks must examine loan portfolio databases and verify the information is classified correctly. Coding errors and other inaccuracies often present a distorted picture of CRE concentrations.

- Analyze concentration risk. Banks can perform a risk analysis to expose both portfolio and loan sensitivity. Well-planned and carefully executed loan stratification can help management have a deeper understanding of their concentrations. Banks, even those not required to perform stress testing, should incorporate stress testing at the loan and portfolio levels.

- Mitigate CRE risk. Banks should establish policies and processes to monitor CRE loan performance and to adjust the mix of the portfolio as their risk appetite changes. Oversight of credit portfolio management is critical, as is an effective management information system.

- Report to management and the board. Reporting on a regular basis should include an update on mitigation efforts for any identified concentrations. Banks with higher levels of CRE loan activity might invest in dashboard reporting systems. The loan review and internal audit departments also should present additional reporting.

Loan Review and Stress Testing

Benefits can be gained by implementing a more dynamic loan review function that takes advantage of technology to identify portfolio themes and trends. The loan review function should identify if management reporting lacks granularity or other forms of risk associated with appraisal quality and underwriting practices.

Stress-testing practices can offer additional understanding of the effects economic variables might have on the portfolio. Tweaking several inputs can reveal how sensitive the bank’s models are to various scenarios. Stress testing can help facilitate discussions to better understand the loan portfolio and to identify better-performing borrowers and segments.

Other Best Practices

Other effective practices include establishing a CRE committee, creating a CRE dashboard, and adapting reporting functions to incorporate the loan pipeline. This approach can help management envision what concentrations will look like in the future if potential opportunities are funded. As CRE concentrations continue to attract regulatory scrutiny, risk management practices will become even more important to banking organizations.