Should Banks Repurchase Stock Right Now?

Brought to you by Raymond James

With expectations of regulatory reform and growth in organic capital generation, it is generally expected that over the next 12 months banks will continue to return capital to shareholders through continued M&A activity, dividend increases or share buybacks.

With expectations of regulatory reform and growth in organic capital generation, it is generally expected that over the next 12 months banks will continue to return capital to shareholders through continued M&A activity, dividend increases or share buybacks.

Given the current market environment, it is an opportune time for banks to consider initiating a share repurchase program.

As market volatility continues, a growing number of banks have been implementing share repurchase – or stock buyback – strategies to manage capital and shore up stability. During volatile periods, financial companies are frequently the first to feel the pain, and buyback programs are a means of getting in front of potential price dips and preserving value.

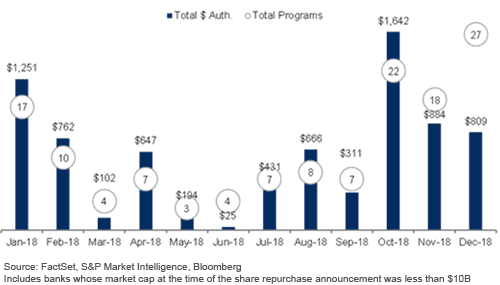

The buyback market set records in 2018 across many industries. As of late December, more than $1 trillion in share repurchase programs had been authorized – eclipsing the $655 billion total for 2017. The third quarter of 2018 was especially active, with financial institutions making up the third-largest sector. In the bank buyback space alone, 22 repurchase programs were announced in October, 18 in November and 27 in December.

Generally, companies that participate in share repurchase programs are carrying cash on the balance sheet in excess of what is necessary to fund daily operations and growth opportunities. The question then becomes how to use it. Given the relative slowdown lately in the M&A market, buybacks have presented banks with the opportunity to accomplish a variety of goals.

Reasons why banks undertake share repurchase programs:

- Reducing the number of outstanding shares can be accretive to earnings per share, making the company more attractive to investors

- A buyback signals to the market that a bank views its share price as undervalued

- It can absorb overhang from capital markets transactions

- These programs can help manage or optimize capital structure

- They return excess capital to shareholders

- Buybacks can offset or mitigate the dilution from employee equity compensation awards

What banks should keep in mind when pursuing buybacks:

- It will reduce capital available for future growth and acquisitions

- A buyback utilizes cash and regulatory capital and may impact book value

- They will likely reduce the number of shareholders and future share liquidity.

- The impacts are temporary.

- Blackout periods may apply.

- Banks with pending acquisitions where the target shareholder vote has not taken place cannot execute a buyback unless the transaction is paid with solely cash, or unless the bank was repurchasing shares pursuant to SEC Rule 10b-18 in the three months preceding the announcement.

While there is no cookie-cutter profile for companies that elect to participate in share repurchase programs–they vary in terms of market capitalization, balance sheet composition and industry sector – there is a well-defined and strictly regulated process these types of transactions must follow.

While SEC Rule 10b-18 governs the parameters of a buyback, including the manner of purchase, the timing of the repurchases, the prices paid and the volume of shares repurchased, companies executing a buyback program should consider the benefits of Rule 10b5-1.

The rule provides companies the ability to establish a buyback plan in an open window that can be executed during closed trading periods. Many companies establish 10b5-1 plans to ensure continuous execution of their buyback strategy and to take advantage of periods of market volatility where opportunistic purchases may be realized.

The buyback market is busy and breaking records. The Corporate & Executive Services team at Raymond James has discussed repurchase programs with more than 50 regional banks in recent months.

Now is a good time for banks with excess capital to weigh their options and reach out to partner firms that can help develop and execute successful repurchase strategies.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value. © 2019 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC. © 2019 Raymond James Financial Services, Inc., member FINRA/SIPC. Raymond James® is a registered trademark of Raymond James Financial, Inc.