Making Blockchain a Reality

FinXTech Advisor, Christa Steele, has created a four part series to educate our community about how blockchain is changing the transaction of digital information, its implications and the players who are shaping this technology. Below is Part Three of this series.

Though blockchain is still in early stage development, one of the most notable blockchain applications took place last fall between Commonwealth Bank of Australia and Wells Fargo. An Australian cotton trader purchased a shipment of cotton from a company in Texas and had it sent to China. The blockchain trade consisted of 88 bales of cotton, totaling $35,000. The two banks shadowed the normal trade process utilizing blockchain technology to create verifiable digital records automatically replicated for all parties in a secure network eliminating the need for third-party verification, and to make automatic payments when the shipment reached certain geographic locations. This greatly reduced duplication (checking and re-checking) of payment processing, manual errors and long standing time constraints from being in multiple time zones during the course of shipment.

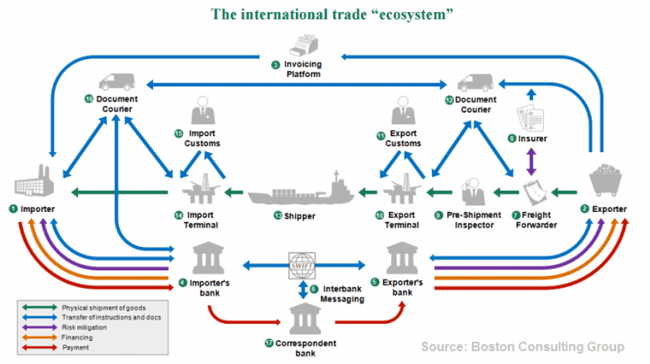

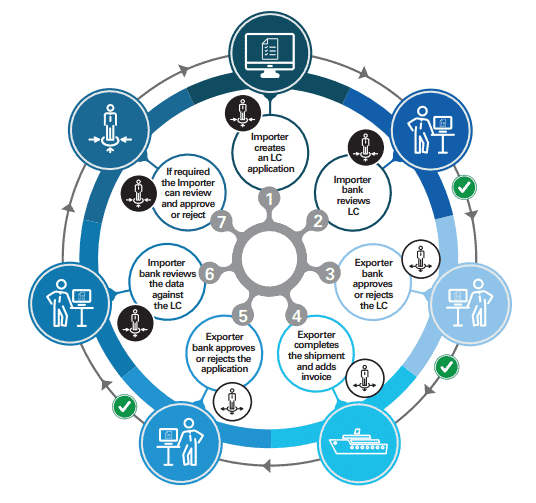

Typical bank involvement in the international trade process:

Any bank offering trade services to its customers either directly or through a correspondent bank via a letter of credit can appreciate how cumbersome, risky and redundant this process is today. The international trade ecosystem is ripe for disruption.

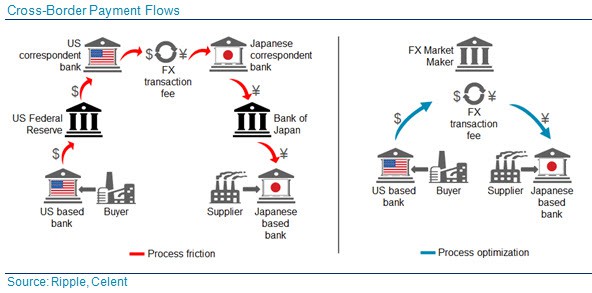

Other recent examples include HSBC Bank and State Street Corp. successfully testing bond transactions and UBS and Santander testing a new cross-border payments process.

Here is how cross-border payments work today and how blockchain streamlines the process:

More than 75 banks worldwide have joined blockchain consortiums or formed partnerships with companies such as R3, ConsenSys, Ripple, Digital Asset Holdings, IBM, Microsoft and others. Many of these banks have established innovation labs for blockchain and other related technology initiatives. Some are more serious than others about implementation versus trying to boast an image of being innovative.

I encourage you to read “The Blockchain Will Do to the Financial System What the Internet Did to Media,” published by the Harvard Business Review in March 2017. The title says it all and the article is backed up by some pretty powerful intelligence and market data.

Banks and related financial services companies have already begun patenting blockchain technologies for themselves, including Goldman Sachs, Bank of America and Mastercard.

Last Fall, IBM reported that within four years, 65 percent of banks globally expect to have blockchain in commercial production or at scale. IBM interviewed 200 global banks and reported that 15 percent will be using some form of blockchain technology by end of 2019.

These banks are all focused on lending, payments and reference data (real time information) sharing of transactions across business divisions and between banks.

What are some hurdles to making blockchain work for banks?

With all of the energy and momentum behind blockchain there are also signs of fatigue and plenty of challenges. There are lots of ongoing discussions surrounding this topic. Morgan Stanley’s Global Insights report published last year sums it up best by identifying the ten key hurdles to making blockchain a reality.

What needs to happen to make this a reality?

There are four keys to long-term success:

- Continued education about blockchain technology to the public and private sector.

- Consensus among and between financial institutions and regulatory bodies.

- For individual institutions, a determination of whether if blockchain is a valid solution.

- Commercial bank clients begin to adopt the technology ahead of the banks themselves and bank regulatory bodies, forcing all to assimilate to some form of distributed ledger technology.

When do we anticipate certain milestones being achieved?

We are already seeing the achievement of important milestones. Though some may perceive these advances as baby steps, they are still a step in the right direction. While I remain optimistic, I am also realistic and know that something as complex and regulated as the U.S. financial system will take time to adopt this technology. I predict that other industry verticals will make active use of blockchain before the U.S. financial system, but only time will tell.